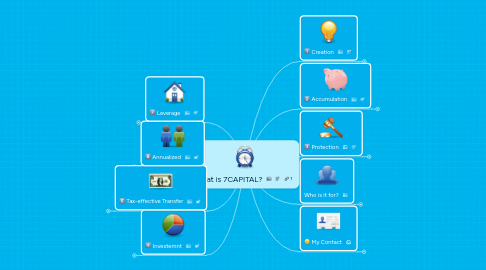

1. Investemnt

1.1. The ART

1.1.1. Amount?

1.1.2. Risk?

1.1.3. TIME

1.1.3.1. Tax free?

1.1.3.2. Inflation adjusted?

1.1.3.3. Mistake

1.1.3.4. Emergency $

1.2. Game Plan?

1.2.1. IPS

1.2.2. AAS

1.3. Risk Type

1.3.1. High

1.3.2. Medium

1.3.3. Low

1.4. Objective

1.4.1. Reasonable?

1.4.1.1. Make Money

1.4.1.2. Do not lose $

1.4.1.3. Shortest possible time

1.5. Fundamentals

1.5.1. Wealth Building

1.5.1.1. Saving

1.5.1.1.1. Income

1.5.2. Diversification

1.5.3. Rule 72

1.5.4. DCA

1.5.5. EURO

1.5.6. Economic

1.5.6.1. Good

1.5.6.1.1. Equity

1.5.6.2. Neural

1.5.6.2.1. Sideway

1.5.6.3. Bad

1.5.6.3.1. Bond

1.5.7. Inflation

2. Tax-effective Transfer

2.1. Transfer

2.1.1. Estate

2.1.1.1. Create

2.1.1.2. Preserve

2.1.1.3. Distribute

2.1.2. Issue

2.1.2.1. Cost

2.1.2.2. Confusion

2.1.2.3. Conflicts

2.1.2.3.1. defer

2.1.2.3.2. decrease

2.1.2.3.3. dump

2.1.3. Aim

2.1.3.1. Protect

2.1.3.2. Preserve

2.1.3.3. Perpetutae

2.2. Tax

2.2.1. Tax evasion

2.2.2. Tax avoidance

2.2.2.1. Relief

2.2.2.2. Tax incentive

2.2.2.3. Tax Saving

2.2.2.3.1. SRS

3. Annualized

3.1. Period

3.1.1. Pre

3.1.2. Adjustment

3.1.3. Post

3.2. Source of income

3.2.1. accumulated saving

3.2.2. CPF Life

3.2.3. Investment portfolio

3.2.3.1. Conservative

3.2.3.2. Balanced

3.2.4. Real Estate

3.2.5. Annuity

4. Leverage

4.1. Double edged Sword

4.1.1. Love

4.1.2. Hate

4.2. Type

4.2.1. Car

4.2.2. Real Estate

4.2.2.1. Residential

4.2.2.2. Commercial

4.3. Loan

4.3.1. Tenure

4.3.1.1. Short

4.3.1.2. Long

4.3.2. Interest rate

4.3.2.1. Flat rate

4.3.2.2. Flexible rate

4.3.3. Repayment

4.3.3.1. Fixed

4.3.3.2. Extra payment

4.3.4. Market condition

4.3.4.1. Up trend

4.3.4.2. Down trend

4.3.4.3. Sideway

5. Creation

5.1. Set your financial goal

5.1.1. Your Game Plan

5.1.1.1. SMARTly

5.1.1.1.1. Specific

5.1.1.1.2. Measurable

5.1.1.1.3. Achieveable

5.1.1.1.4. Realistic

5.1.1.1.5. Time

5.1.2. MVG

5.1.2.1. Mission

5.1.2.1.1. DOME

5.1.2.2. Vision

5.1.2.2.1. Discipline

5.1.2.2.2. Clarity

5.1.2.2.3. Focus

5.1.2.3. Goal

5.1.2.3.1. Short

5.1.2.3.2. Medium

5.1.2.3.3. Long

5.1.3. Direction

5.1.3.1. MAP

5.1.3.1.1. Wealth Maintenance

5.1.3.1.2. Wealth Accumulation

5.1.3.1.3. Wealth Protection

5.1.3.1.4. Wealth Enhancement

5.1.3.1.5. Wealth Distribution

5.1.4. Process

5.1.4.1. H.E.A.R.D.

5.1.4.1.1. Homework

5.1.4.1.2. Engagement

5.1.4.1.3. Anlaysis

5.1.4.1.4. Recommendation

5.1.4.1.5. Documentation

5.1.5. Methodology

5.1.5.1. Information Intelligence

5.1.5.2. Analysis

5.1.5.3. Recommendation

5.1.5.4. Implementation

5.2. Financial Statement

5.2.1. Income Statement

5.2.1.1. Income

5.2.1.1.1. Effort

5.2.1.1.2. Passive

5.2.1.2. Expenditure

5.2.1.2.1. Outflow

5.2.1.2.2. Saving Program

5.2.2. Balance Sheet

5.2.2.1. Asset

5.2.2.1.1. Tangible

5.2.2.1.2. The intangible

5.2.2.2. Liabilities

5.2.2.2.1. Short term

5.2.2.2.2. Long term

5.3. Estate

5.3.1. Legacy

5.3.1.1. Financial asset

5.3.1.2. Non-financial asset

5.3.2. Values

5.3.2.1. Clarity

5.3.2.2. Balanced

5.3.2.3. Focus

5.3.2.4. Confidence

5.4. Budget

5.4.1. Evaluate what you spend

5.4.2. Allocate income

5.4.3. Set up spending priorities

5.4.4. Pay yourself first

6. Protection

6.1. Principles

6.1.1. Idemnity

6.1.2. Insurable Interest

6.1.3. Utmost Good Faith

6.1.4. Basis of Reasonableness

6.2. Risk Management

6.2.1. Avoid

6.2.2. Reduce

6.2.3. Transfer

6.2.4. Accept

6.2.4.1. Self-Insured

6.3. Circle of Life

6.3.1. Death

6.3.2. TPD

6.3.3. Medical

6.3.4. Critical illness

6.3.4.1. lump sum

6.3.4.2. deferred period

6.3.4.3. maturity age

6.3.4.4. tax free claims

6.3.4.5. any occupation

6.3.4.6. no ongoing check

6.3.5. Personal Accident

6.3.6. Disability Income / LTC

6.3.6.1. income replacement

6.3.6.2. subject to % cover

6.3.6.3. own occupation for DII

6.3.6.4. ongoing check

6.4. Issues

6.4.1. Die too young

6.4.2. Diagnosis with Critical Illnesses

6.4.3. Accidental Injury

6.4.4. Live too long

6.5. Options

6.5.1. coverage vs premium vs need

6.5.1.1. Term

6.5.1.1.1. limited pay

6.5.1.1.2. pay as you live

6.5.1.2. Whole Life

6.5.1.2.1. limited pay

6.5.1.2.2. life payment

6.5.1.2.3. single pay

6.5.1.3. Endowment

6.5.1.3.1. term

6.5.1.3.2. pay out

6.5.1.4. Combination

6.5.1.4.1. cost-effective options

6.5.1.4.2. InS+InV options

6.5.1.4.3. needs based analysis

6.5.1.5. Annuity

7. Accumulation

7.1. Save

7.1.1. Structured

7.1.1.1. Fixed Period

7.1.1.1.1. Inflexible

7.1.1.1.2. Disciplined

7.1.1.2. Low risk

7.1.1.2.1. With profit

7.1.1.2.2. skewed to bond

7.1.1.2.3. life coverage option

7.1.1.3. tax free return

7.1.1.3.1. tax internally

7.1.2. Non-Structured

7.1.2.1. Flexible

7.1.2.1.1. Flexible term

7.1.2.1.2. Required Discipline

7.1.2.2. Medium to high risk

7.1.2.2.1. equity-based

7.1.2.2.2. volatility

7.1.2.2.3. Performance-based

7.1.2.3. Partially tax-free maturity

7.1.2.3.1. Partially taxed

7.2. Invest

7.3. Protect

7.3.1. Inflation-adjusted

7.3.2. Unexpected Event

7.4. Preserve

7.4.1. Longevity

8. Who is it for?

8.1. Busy professionals

8.2. accumlator

8.3. in control

9. My Contact

9.1. Contact Chew Hock Beng

9.1.1. mObile @ +65 9389 7195

9.1.2. eMail

9.1.3. bloG