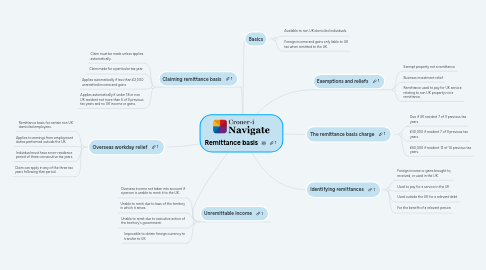

Remittance basis

by Laura Burrows

1. Claiming remittance basis

1.1. Claim must be made unless applies automatically.

1.2. Claim made for a particular tax year.

1.3. Applies automatically if less than £2,000 unremitted income and gains

1.4. Applies automatically if under 18 or non UK resident not more than 6 of 9 previous tax years and no UK income or gains.

2. Overseas workday relief

2.1. Remittance basis for certain non UK domiciled employees.

2.2. Applies to earnings from employment duties performed outside the UK.

2.3. Individual must have a non-residence period of three consecutive tax years.

2.4. Claim can apply in any of the three tax years following that period.

3. Unremittable income

3.1. Overseas income not taken into account if a person is unable to remit it to the UK.

3.2. Unable to remit due to laws of the territory in which it arises.

3.3. Unable to remit due to executive action of the territory's government.

3.4. Impossible to obtain foreign currency to transfer to UK.

4. Exemptions and reliefs

4.1. Exempt property not a remittance

4.2. Business investment relief

4.3. Remittance used to pay for UK service relating to non UK property not a remittance.

5. The remittance basis charge

5.1. Due if UK resident 7 of 9 previous tax years.

5.2. £30,000 if resident 7 of 9 previous tax years.

5.3. £60,000 if resident 12 of 14 previous tax years.

6. Identifying remittances

6.1. Foreign income or gains brought to, received, or used in the UK.

6.2. Used to pay for a service in the UK

6.3. Used outside the UK for a relevant debt.

6.4. For the benefit of a relevant person.

7. Basics

7.1. Available to non UK domiciled individuals.

7.2. Foreign income and gains only liable to UK tax when remitted to the UK.