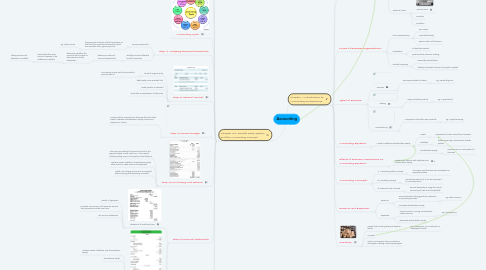

1. Chapter 2/3: Double Entry System and the Accounting Concept

1.1. Double-Entry System:

1.1.1. shows an increase and decrease in each item of the accounting equation by accounts

1.1.2. records information in chronological order

1.2. Account Formats:

1.2.1. T-Account Format

1.2.2. Accounting Columnar Format

1.3. Accounting Concepts:

1.3.1. 1) Accounting Period Concept

1.3.1.1. life span of the business broken into regular intervals and financial statements are prepared at the end of each accounting period

1.3.2. 2) Going Concern Concept

1.3.2.1. assumes that the business will continue to operate for a long time and assets are valued at a historical cost

1.4. Accounting Cycle:

1.5. Step 1) Analysing business transactions

1.5.1. Source Documents

1.5.1.1. they provide evidence of the transaction as well as other important information which are recorded into a general journal

1.5.1.1.1. eg. sales invoice

1.5.2. identify accounts affected by the transaction

1.5.2.1. determine nature of accounts (assets,etc,)

1.5.2.1.1. determine whether the accounts will increase or decrease due to the transaction

1.6. Step 2) General Journal:

1.6.1. book of original entry

1.6.1.1. accounting entries are first recorded in general journal

1.6.2. debit entry's are recorded first

1.6.3. credit portion is indented

1.6.4. ends with an explanation of the entry

1.7. Step 3) General Ledger

1.7.1. contains all the accounts of a business that are either assets, liabilities, shareholders’ equity, revenues or expenses in nature

1.8. Step 4) Pre-Closing Trial Balance

1.8.1. When we are posting the general journal to the general ledger, errors may occur. One way to detect posting errors is to prepare a trial balance

1.8.2. contains assets, liabilities, shareholders equity, sales revenue, sales returns and expenses

1.8.3. called 'Pre-Closing' because it is prepared before closing the temporary accounts.

1.9. Step 5) Financial Statements

1.9.1. Statement of Profit and Loss

1.9.1.1. results of operation

1.9.1.2. provides a summary of all revenues earned and expenses incurred over time

1.9.1.3. aka Income Statement

1.9.2. Statement of Financial Position

1.9.2.1. contains assets, liabilities, and shareholders equity

1.9.2.2. aka Balance Sheet

1.9.3. classify all accounts in pre-closing trial balance and put them to respective financial statements

1.10. Step 6) Closing Entries

1.10.1. Transfer all temporary accounts to Profit or Loss Account

1.10.1.1. Transfer amount in the Profit or Loss account to the Retained Earnings account

1.10.2. closing of temporary accounts like:

1.10.2.1. revenue

1.10.2.2. contra-revenue

1.10.2.3. expenses

1.11. Step 7) Post-Closing Trial Balance

1.11.1. contains assets, liabilities, shareholders equity, retained earnings

1.11.2. total debit should equal credit

1.11.3. after closing all the temporary accounts the remaining will be the permanent accounts.

2. Chapter 1: Introduction to Accounting and Business

2.1. Accounting Definition:

2.1.1. Accounting is a process of analysing, recording, summarising, reporting, and interpreting financial information of a business

2.2. Accounting information is used by:

2.2.1. Internal Users:

2.2.1.1. Managers

2.2.1.2. Owners

2.2.1.3. Employees

2.2.2. External Users:

2.2.2.1. Government

2.2.2.2. Investors

2.2.2.3. Creditors

2.3. Forms of Business Organisations:

2.3.1. Sole Proprietorship

2.3.1.1. one owner

2.3.1.2. unlimited liability

2.3.1.3. owner makes all decisions

2.3.2. Partnership

2.3.2.1. at least two owners

2.3.2.2. partners share decision making

2.3.3. Limited Company

2.3.3.1. owned by shareholders

2.3.3.2. liability is limited to amount of capital invested

2.4. Types of Business

2.4.1. Services

2.4.1.1. services provided to clients

2.4.1.1.1. eg. Consulting Firm

2.4.2. Trading

2.4.2.1. buys and sells products

2.4.2.1.1. eg. Supermarket

2.4.3. Manufacturing

2.4.3.1. companies make their own products

2.4.3.1.1. eg. Apple/Samsung

2.5. Accounting Equation:

2.5.1. Assets=Liabilities+Shareholders Equity

2.5.1.1. Assets

2.5.1.1.1. properties of value owned by a business

2.5.1.2. Liabilities

2.5.1.2.1. debts owned by a business to outside parties

2.5.1.3. Shareholders Equity

2.5.1.3.1. owners claim on net assets of a business

2.6. Effects of Business Transactions on Accounting Equation:

2.6.1. Assets must balance with liabilities and Shareholders equity

2.7. Accounting Concepts:

2.7.1. 1) Accounting Entity Concept

2.7.1.1. The owner and business are considered as separate entities

2.7.2. 2) Monetary Concept

2.7.2.1. Record transactions if it can be measured in monetary terms

2.7.3. 3) Historical Cost Concept

2.7.3.1. Record transactions using the actual amount paid. (will not be adjusted)

2.8. Revenue and Expenses:

2.8.1. Revenue:

2.8.1.1. amount earned selling goods to customers or providing services

2.8.1.1.1. eg. sales revenue

2.8.1.2. increases shareholders equity

2.8.2. Expenses:

2.8.2.1. cost incurred in running a business to create revenue

2.8.2.1.1. eg. rent expense

2.8.2.2. decreases shareholders equity

2.9. Inventory:

2.9.1. goods that a trading business buys for resale

2.9.1.1. eg. newspapers are inventory to a newspaper vendor

2.9.2. an asset

2.9.3. returns can happen when inventory is damaged or wrong inventory was given