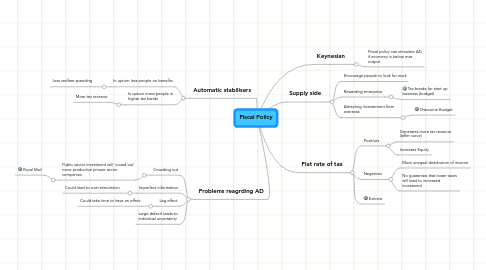

Fiscal Policy

by Tom Dimaio

1. Automatic stabilisers

1.1. In upturn less people on benefits

1.1.1. Less welfare spending

1.2. In upturn more people in higher tax bands

1.2.1. More tax revenue

2. Problems reagrding AD

2.1. Crowding out

2.1.1. Public sector investment will 'crowd out' more productive private sector companies

2.1.1.1. Royal Mail

2.2. Imperfect information

2.2.1. Could lead to over-stimulation

2.3. Lag effect

2.3.1. Could take time to have an effect

2.4. Large defecit leads to individual uncertainty

3. Keynesian

3.1. Fiscal policy can stimulate AD if economy is below max output

4. Supply side

4.1. Encourage people to look for work

4.2. Rewarding enterprise

4.2.1. Tax breaks for start up business (budget)

4.3. Attracting investement from overseas

4.3.1. Osbourne Budget

5. Flat rate of tax

5.1. Positives

5.1.1. Generates more tax revenue (laffer curve)

5.1.2. Increases Equity

5.2. Negatives

5.2.1. More unequal distribution of income

5.2.2. No guarantee that lower taxes will lead to increased investment